Investing in multifamily real estate presents a lucrative opportunity, offering both immediate cash flow and long-term appreciation. However, one of the most critical decisions investors face is whether to acquire an aging property with value-add potential or invest in a newly constructed multifamily asset. Each option presents unique advantages and challenges.

As amultifamily renovation company, we frequently work with investors navigating this choice. This guide breaks down the pros and cons of both investment strategies to help you make an informed decision that aligns with your objectives.

Table of Contents

ToggleInvesting in Aging Multifamily Properties

Older multifamily properties often come with a lower purchase price, making them attractive to investors looking for affordability and immediate rental income. Many of these properties are located in well-established neighborhoods with strong demand, providing stability and long-term growth potential.

Advantages of Aging Properties

- Lower Acquisition Costs – Older multifamily properties generally have a lower purchase price per unit compared to new developments, making them more accessible for investors with limited capital.

- Immediate Cash Flow – Since most aging properties are already leased, investors can start generating rental income immediately without waiting for lease-ups.

- Established Neighborhoods – Older buildings are often in prime, high-demand rental markets with existing amenities, public transportation, and commercial hubs, which contribute to tenant retention and property appreciation.

- Value-Add Opportunities – Investors can renovate interiors, upgrade amenities, and improve operational efficiencies to increase rent potential and overall property value.

Challenges of Aging Properties

- Higher Maintenance and Repair Costs – Aging infrastructure, including plumbing, electrical, and HVAC systems, may require significant upgrades, leading to increased capital expenditures.

- Compliance and Safety Concerns – Older buildings may not meet modern safety codes and energy efficiency standards, requiring costly retrofits to remain competitive and legally compliant.

- Outdated Amenities – Older properties may lack the smart home features, high-speed internet infrastructure, and luxury finishes that modern renters seek.

- Higher Operating Costs – Aging properties often have higher utility costs due to outdated insulation, inefficient appliances, and older building materials.

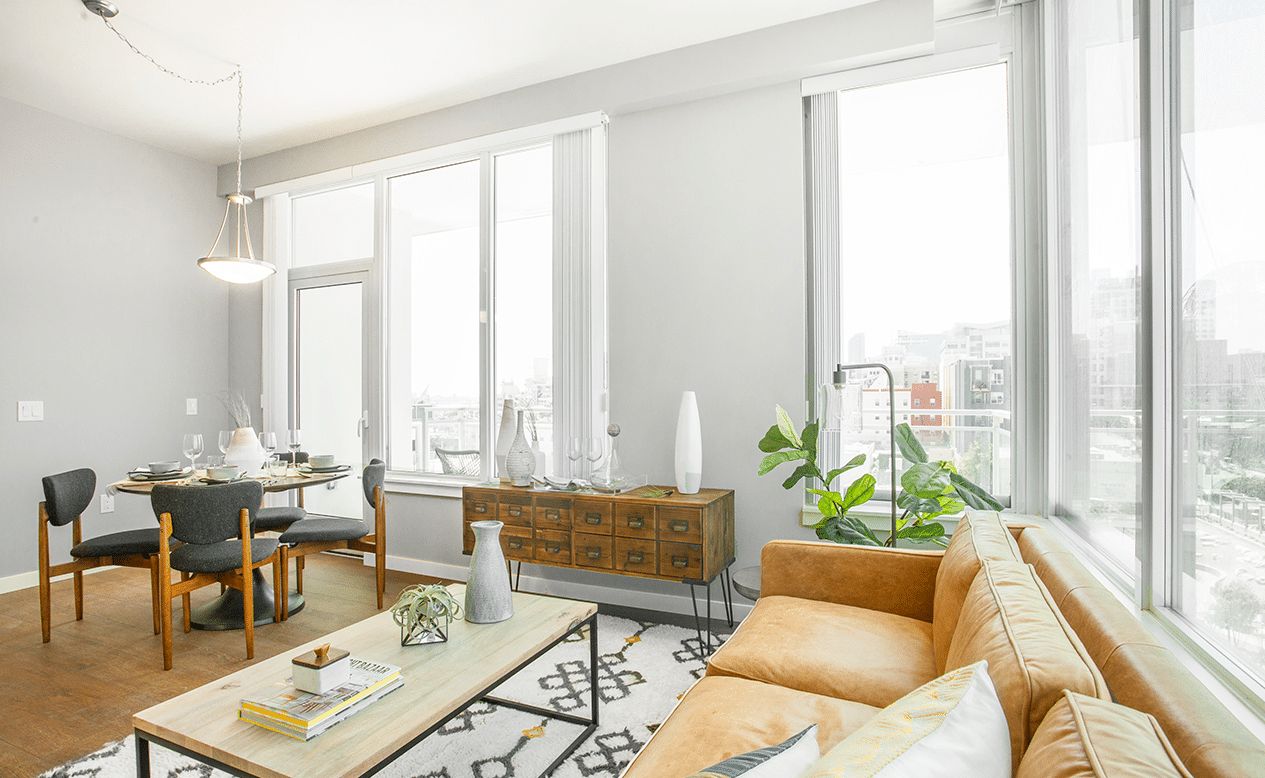

Investing in New Multifamily Builds

New multifamily developments are designed with the latest technology, energy-efficient systems, and contemporary layouts that cater to today’s renters. While these properties require a higher initial investment, they also offer numerous advantages in terms of tenant demand and lower operational costs.

Advantages of New Builds

- Lower Maintenance and Repair Costs – New developments require minimal maintenance for the first several years, reducing unexpected repair expenses.

- Modern Amenities and Design – New properties include high-end finishes, open layouts, and smart technology, which appeal to renters willing to pay premium rents.

- Energy Efficiency – Modern construction incorporates energy-efficient HVAC systems, better insulation, and eco-friendly materials, leading to lower utility costs and increased tenant satisfaction.

- Higher Tenant Demand and Faster Lease-Ups – New builds are highly attractive to tenants, often leading to lower vacancy rates and higher rental income.

Challenges of New Builds

- Higher Initial Investment – The purchase price of newly constructed multifamily properties is significantly higher than aging properties, requiring investors to secure more capital or favorable financing.

- Longer Lease-Up Period – Unlike aging properties with existing tenants, new developments often require time to achieve full occupancy, which can delay immediate cash flow.

- Market Volatility & Location Risks – Many new developments are in emerging areas with uncertain long-term demand. Investors must assess neighborhood growth potential and infrastructure development.

- Higher Property Taxes – New properties may have higher tax assessments, increasing overall ownership costs.

Which Multifamily Investment Is Right for You?

The decision between investing in aging properties versus new builds strongly depends on your financial strategy and risk tolerance.

- If you prefer lower upfront costs and are willing to invest in renovations for long-term appreciation, an aging property may be the right choice.

- If you prioritize low maintenance, energy efficiency, and attracting premium tenants, a new build may be a better fit.

- Consider factors such as rental demand, location, and financing options before making a decision.

Both aging multifamily properties and new builds offer unique advantages and challenges. Conducting thorough due diligence and aligning your investment choice with your long-term goals will help you make a successful investment decision.

#Mulitifamily #MultifamilyProperties #Renovations #MultifamilyRenovations #Atlanta #Houston #Denver #California #MultifamilyInvestment #AgingProperties #NewbuildProperties #MultifamilyRenovationCompanies #MultifamilyGeneralContractors #Investment #InvestmentProperties