Multifamily investing remains a reliable strategy for building wealth, creating steady cash flow, and strengthening a real estate portfolio. Yet, behind every successful multifamily property is careful planning, especially when it comes to the condition of the building and the renovations that will follow.

Failing to assess these crucial elements can lead to unexpected repairs, unhappy tenants, and ultimately, a negative impact on your bottom line. Savvy investors know that success isn’t just about buying the right property, it’s about buying smart with a long-term strategy in mind.

Table of Contents

ToggleWhy Structural and Renovation Planning Makes a Difference

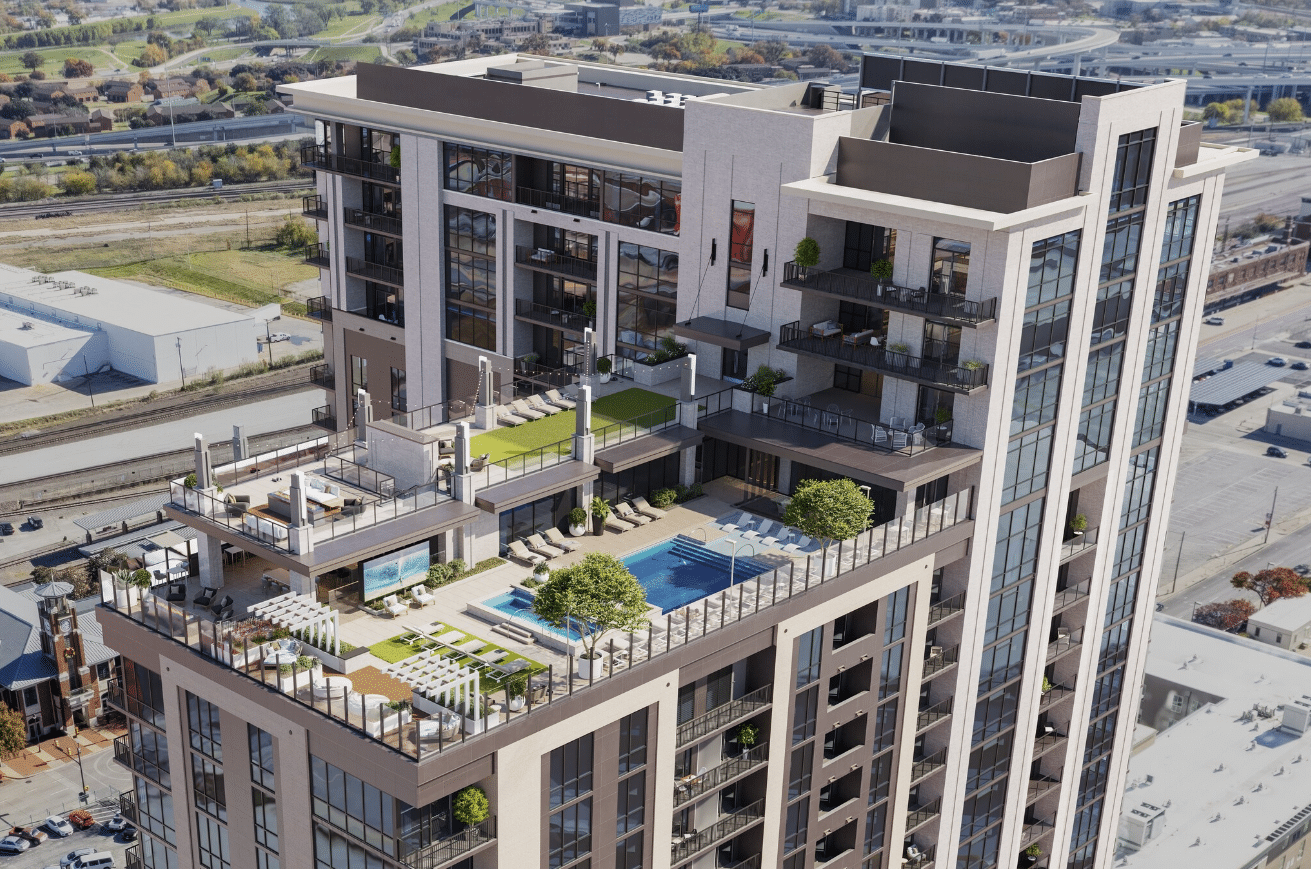

At the heart of any successful multifamily investment is the property’s structural soundness. Cracks in the foundation, aging mechanical systems, or a worn roof can quickly turn a good investment into a costly one. On the flip side, smart renovations can boost a property’s value, attract stronger tenants, and improve efficiency.

Whether you’re eyeing a Class A asset in a booming metro or repositioning an older building in an up-and-coming neighborhood, knowing what to fix and upgrade before closing the deal gives you an edge.

What to Watch for: Key Structural Considerations

A thorough property inspection is non-negotiable. The following areas should be at the top of your list:

- Foundation

Signs of shifting, cracking, or settling can be costly to repair and could undermine the whole structure. - Roof

Leaks or poor insulation can lead to long-term moisture issues and expensive maintenance. - Mechanical Systems

Outdated HVAC, electrical, and plumbing systems drive up operating costs and may not meet modern codes. - Windows & Insulation

Especially in colder climates, inefficient windows or poor insulation can hurt energy performance and tenant comfort. - Code Compliance

Properties that don’t meet current fire safety and structural codes can require costly retrofits and slow down your timeline.

Renovation Strategies That Pay Off

Once you’ve confirmed the property is structurally sound (or accounted for necessary repairs), it’s time to focus on improvements that will move the needle. Not all renovations are created equal – here’s where to prioritize:

- Kitchen and Bath Upgrades

These areas offer the most noticeable returns. Modern cabinetry, fixtures, and countertops can justify premium rents. - Energy-Efficient Improvements

Tenants and investors alike appreciate lower utility bills. LED lighting, smart thermostats, and better insulation can make a difference for tenants. - Security Enhancements

Gated entries, smart locks, and surveillance systems add peace of mind for residents and can help reduce vacancy rates. - Curb Appeal

A fresh exterior, clean landscaping, and welcoming common areas create a positive first impression that can differentiate your property from nearby competition.

Why Location Still Reigns Supreme

Even the best renovation won’t save a property in a declining neighborhood. Look for fundamentals like:

- Access to public transit and employment centers

- Low neighborhood crime rates

- Good school districts and nearby amenities

- Healthy vacancy rates and rent growth

Market research at this stage helps you avoid investing in areas with softening demand or long-term headwinds.

Financial Planning: Budgeting and ROI in the Real World

Beyond property condition, your financial model will make or break your investment. Before moving forward, ask:

- Are you budgeting realistically for repairs and renovations?

- Do your Cap Rate and ROI projections factor in both short-term improvements and long-term maintenance?

- Have you accounted for ongoing operating expenses like taxes, utilities, and insurance?

Also, explore financing options that match your project’s scope, whether it’s a conventional mortgage, FHA loan, or a commercial product tailored to value-add investments.

Choosing the Right General Contractor

Experienced multifamily contractors aren’t just there to swing hammers, they help you optimize costs, avoid project delays, and ensure compliance with local regulations. Look for partners who:

- Have a proven track record with multifamily projects

- Understand your target tenant base (e.g., luxury, workforce, or mid-market housing)

- Communicate clearly and manage timelines effectively

Don’t Overlook Maintenance: The Long Game

After the dust settles on renovations, a proactive maintenance plan is essential. Routine inspections and preventive maintenance reduce expensive emergency repairs, and satisfied tenants are more likely to renew leases, improving your long-term cash flow.

Strong tenant relationships, streamlined property management systems, and consistent upkeep keep your asset competitive and reduce costly turnover.

Final Thoughts

A successful multifamily investment is built on solid foundations, literally and figuratively. By pairing structural due diligence with smart renovation choices and sharp financial planning, you position your asset for long-term success.

Considering a renovation project?

Renu’s team of experts can help you plan and execute your multifamily upgrades with confidence. Contact us today to learn more!

#Mulitifamily #MultifamilyRenovations #StructuralRenovations #LasVegas #Phoenix #Denver #Houston #SanDiego #RenovationContractors #GeneralContractors #MultifamilyContractors #MultifamilyInvestments #RealEstate